Collision Course – Record Margins Meet Rising Costs

September 23, 2021

To Inform:

One of the biggest tailwinds to the strong stock market returns in the US over the past decade is the expanding profit margins in publicly traded US companies. Expanding margins, the result of lower interest rates, steady input costs (materials and labor) and modest price increases have contributed to this rise in profit margins. A decade ago, operating margins were below 15%. A steady rise throughout the decade with both higher highs and higher lows was quickly wiped out last spring. A blockbuster recovery has since catapulted margins to new highs.

Source: Strategas

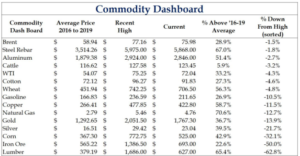

What does this all mean for stock prices? If profit margins are high and growing, equities are likely to continue to do well. That said, our job is to ask, “what can go wrong here?” What could send profit margins lower? One thing we’re watching is rising input costs. We’ve paid close attention to the inflation story over the last few quarters and believe that inflation is a higher risk to corporate profits than it has been in a long time. The commodity dashboard seen below from our research partner Strategas notes that the increases in several raw materials have so far proved to be “sticky”. Companies undoubtedly are feeling this pressure. In an article published this week in the Wall Street Journal, it was reported that a large food packaging company expects to raise prices for the remainder of the year as a result of higher costs for everything from raw ingredients to transportation costs.

Source: Strategas

While we’re pleased with the current level of profits and the now 18-month recovery in stocks, it always is wise to consider the risks to the current view. We’re neither “permabulls” or “permabears”. Often, we’re somewhere in the middle. Hopeful for the bull case, but informed and ready for the bear case.

Written by Alex Durbin, Portfolio Manager