Election Themes in 2024

January 12, 2024

To Inspire:

In a year where close to 40% of both global population and global GDP head to the polls, I thought it might be interesting to unpack some of the 2024 political themes our research partners are sharing with us. If you read last week’s Wealthnotes you might recall the average performance of the S&P 500 in election years. We think there is power in reading historical patterns, so what might be the factors driving markets in this election year?

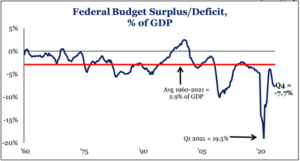

I won’t touch the third rail that is social issues, but I’ll happily grab on to the lesser charged rail of the economic issues facing this country. Whenever I look at the budget deficit and the response of politicians, I am reminded of the quote attributed to St. Augustine: “Lord, make me chaste, but not yet.” Despite a Federal budget deficit well above historical averages, there are elections to be won, and while the deficit may be a theme this year, so will economic stimulus.

Source: Strategas

The urge to stimulate the economy is strong when voters head to the polls, and both sides of the aisle have a history of goosing certain spending tools to put the electorate in a good mood. This year, there is bipartisan chatter for expanding the child tax credit and other stimulative measures.

Why does this happen? The chart below is very telling. Presidents tend to win reelection when voters’ disposable income, accounting for inflation, goes up in the year of the election. Closer elections where a President won re-election (Bush II, Obama) or lost (Carter, Bush I) have tended to occur when voters are feeling less flush.

Source: Strategas

What’s interesting about this year is the mix of high interest costs and the current state of the Federal budget. One of the ingredients of the rally we saw late last year was the expectation that the Federal Reserve begins cutting rates this year. That is our base case, but the risk such moves could pose to the Fed’s inflation battle can’t be ignored. Our research partner Strategas published their forecast for bond yields this year. They see little movement at the long end of the curve, which the Fed has less influence over (5,10,30-year), but continued declines in short rates (1 and 2-year bills).

Source: Strategas

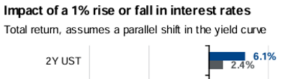

If this forecast proves correct, it means the Fed is likely to cut rates by 3-4 times this year. What this means for investors is that there is likely support for stocks, but also for short-term bonds. The chart below shows the total return in 2-year US Treasury bills if rates fall 1% (blue) or rise 1% (gray). A 1% fall in interest rates for these bills would translate to a 6.1% annualized return.

Source: JPMorgan

The forecasted move down in bond yields and Fed rate cuts probably won’t be a disappointment to the Biden Administration. That said, there are other factors at play in this election, many of which we haven’t seen factor seriously into elections in decades (wars, inflation, border security). We’ll leave discussion for those factors for another time and place!

Written by Alex Durbin, Portfolio Manager