Energy Stocks – Still Unloved

February 18, 2022

To Inform:

It seems like you can’t go an hour without seeing a headline about inflation, or interest rates, or Ukraine. These are all important developments for the market, but they’re all clearly getting their time in the sun. We’ve talked about those issues at some length, and they continue to be front page news. One development that has been much less heralded is the return of oil stocks which are seemingly still unloved by the market, despite double digit returns in 2022. Since hitting pandemic lows of minus $40/bbl, oil prices are now flirting with the $100 level. If this has you scratching your head, it’s instructive to look at both the demand side of the equation and the supply side.

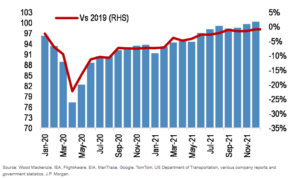

On the demand side of the equation, global oil demand is projected to exceed pre-pandemic levels this year as seen in the chart below. JPMorgan expects oil demand to increase to nearly 110 million barrels per day by the end of the decade, despite increased adoption of things like electric vehicles.

Source: JPMorgan

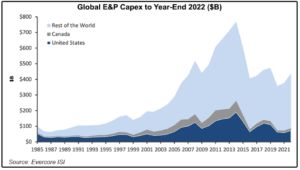

The supply side of the equation has been challenging. Capital discipline, something oil companies placed less emphasis on in the 2010s, is front and center today. This reluctance to overspend on production has had a huge impact on global oil capital expenditure as the chart below demonstrates. Peaking at close to $800 billion in 2014, capital expenditures fell to under $400 billion in 2020.

Source: Naturalgasintel.com

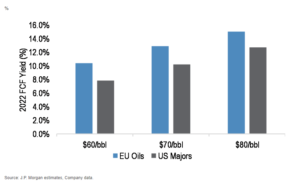

The result of this underinvestment has been shrinking inventories, with global oil inventories recently hitting 7-year lows, and limited spare capacity. This, combined with robust demand, has painted a very rosy picture for oil companies. This rosy picture comes into clear focus when we look at free cash flow yields of oil companies. A helpful way to think about this is free cash flow is good, and the less one has to pay for it the better. The chart below from JPMorgan highlights free cash flow yields for oil companies to be greater than 10% at $80/bbl oil. To put this in perspective, free cash flow yield for the S&P 500 is somewhere around 4%.

Source: JPMorgan

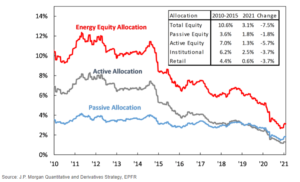

With such wonderful numbers, surely investors must be piling into oil stocks, right? Not yet. Investor allocations to energy stocks are well below levels seen a decade ago. In short, oil stocks remain unloved.

Source: JPMorgan

This quick tour of what’s happening with oil stocks is a good object lesson in how finding unloved assets with good fundamentals (this can’t be emphasized enough) can lead to good investor outcomes. We expect as investors become more comfortable with the outlook for oil companies, the love returns once more to this sector. Beyond that, a thriving energy sector is good for the future of energy. Countries around the world are grappling with how to balance the needs of their people with the importance of reducing carbon emissions. Key in accomplishing this is the expertise and resources of a well-capitalized, well-loved energy sector.

Written by Alex Durbin, Portfolio Manager