Fed and FOMO

June 16, 2023

To Inform:

Every Friday morning at 11am, we hold what we call our ICAT meeting – Investment Communication & Advisor Team. Our entire advisor team gathers, and we typically spend the first 20-30 minutes talking about what is happening in markets and how portfolios are responding before doing a deep dive into financial planning topics. Today’s focus was all investments and while we covered a lot of ground, two key discussion areas were the Fed and FOMO.

Fed – Results of This Week’s Fed Meeting

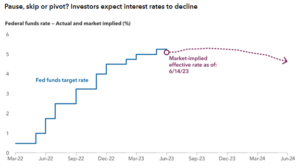

Wednesday (June 14) the Federal Reserve kept their benchmark interest rate unchanged at a range of 5.00% to 5.25% but left the door open to future rate hikes. In his post-meeting statement, Fed Chair Jerome Powell said, “holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.” (Source: CNBC)

The Fed pausing rate hikes at the June meeting was widely expected, however, a surprise came from the Fed’s “dot plot” of future expectations where the Fed projected two more 0.25% increases may be on the way before the end of the year. The Fed’s “dot plot” in which the individual members indicate their expectations for future rates moved upward, pushing the median expectation up to 5.6% by the end of 2023. With the Fed meeting four more times before year end, the implication is for two of those four meetings to include 0.25% rate hikes.

The challenge with the Fed’s view is that the market doesn’t believe it. The chart below reflects market expectations based on Fed Funds Futures as of 6/14, and as you can see from the purple arrow, market expectations are for rates to hold steady and ultimately decline into early 2024, NOT increase. One of our favorite tools, the CME Fed Watch, currently (as of 6/16) puts over 67% odds the Fed funds rate will be the same or lower in January 2024. In other words, we have a big gap between what the Fed is saying and what the market is believing. The market is betting continued declines in inflation will keep the Fed on hold while the Fed is saying more work needs to be done to squash inflation for good. The Fed may have increased its own expectations, but with the market seeing it as an empty threat, we believe it had a minimal impact on markets.

Source: Capital Group, Bloomberg

FOMO – Fear of Missing Out

The second big topic in our ICAT meeting was market psychology, and particularly FOMO – the fear of missing out. Remember three months ago when there were bank failures? The market doesn’t. Big technology companies are rallying, and investors are giddy! We remind investors that market leadership has been narrow. As of 6/16, the YTD performance of the market capitalization (size) weighted S&P 500 is over 16% while the performance of the equally weighted S&P 500 is only 6% – one of the biggest gaps in history.

(NOTE: More on the difference can be found in our WealthNotes from a few weeks ago.)

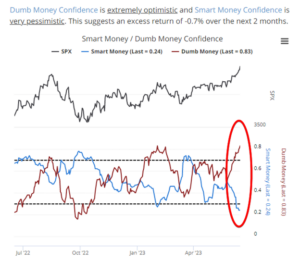

Investors are asking if they should chase the market higher. Here are two charts which have our attention:

First, Alex shared the chart below at our ICAT meeting. I’ll spare you the technicalities, but here is the punchline – the blue line is valuations, and the orange line is earnings. While earnings are unchanged since last September, valuations, or prices are up A LOT. The implication is fundamentals are the same, but prices are higher. Since we would prefer to buy low and sell high, that’s a concern.

Source: Bloomberg

The second chart is an old favorite for WealthNotes readers – the Smart Money/Dumb Money indicator. In general, investors want to follow the “smart money” institutional investors and do the opposite of the more emotional “dumb money” investors. When the two groups have sharply diverging behaviors, it has historically lined up well with potentially important market turning points. As you can see from the chart below, the red line (Dumb Money Confidence) has surged in recent months while the blue line (Smart Money Confidence) has declined. The gap between the two has our attention as it’s historically large.

Source: Sentimentrader.com, Sundial Capital Research

There is always a lot going on in markets and that feels especially true today. On June 28th, we will host our next “Portfolios” event live in our office and Alex and I will talk more about market happenings and changes we are making in client portfolios. We would love to answer your questions and please feel free to invite a friend (RSVP here). We hope to see you there!

Written by Travis Upton, Partner, CEO and Chief Investment Officer