Focus on Scenarios, Not Forecasts

February 7, 2020

To Inform:

This week we are continuing to unpack our “Top 5 Investment Themes for 2020.” These themes reflect the major discussion points we are currently having in our Investment Strategy Team meetings and are driving the way we are positioning client portfolios.

This week’s theme is “Focus on Scenarios, Not Forecasts.” This time of year, there are all sorts of presentations and articles about “forecasting what is ahead for 2020.” I (Travis), had the opportunity to attend a forecast event a couple of weeks ago from a large global investment bank. The presentation had a lot of good information, but here is my take on high points – “Last year we thought we were heading into recession, but now data has improved so we are positive on markets, but here are things that could go wrong…have a good night.” On one hand, the event was a little frustrating because there really was not a forecast, but I appreciated that the speaker was intellectually honest. This is a year with lots of cross-currents geopolitically and economically, not to mention the fact that there is a big election coming up later this year. We would say making an accurate “forecast” for 2020 is virtually impossible, so what do we do about it?

When Coach Ryan Day of the Ohio State Buckeyes is getting ready to face an uncertain opponent, he is not creating a forecast and hoping it is right – he is developing different scenarios for what may play out on the field and has different game plans ready to go for those scenarios. At The Joseph Group, we are trying to do the same thing. We are striving to identify the things we want to see if the markets/economy are having a growth recovery, experiencing stagflation (rising inflation but slow growth), or are moving toward a recession. We have mapped out an investment playbook for each scenario and have assigned a probability of each scenario occurring based on what we are seeing play out in the data.

Currently we put the highest odds on a growth recovery occurring in the economy and markets. In this scenario, we believe global stocks are going to be the asset class of choice with leanings toward real estate and infrastructure. Here are some of the things we are looking for and what we are seeing in the current data:

- We want to see credit conditions remain supportive of the economy. Currently we are seeing “spreads” on junk bonds (the amount of interest junk bonds pay over the government bond rate) at 3.7% which is close to historic lows and supportive of money flowing freely through the banking system.

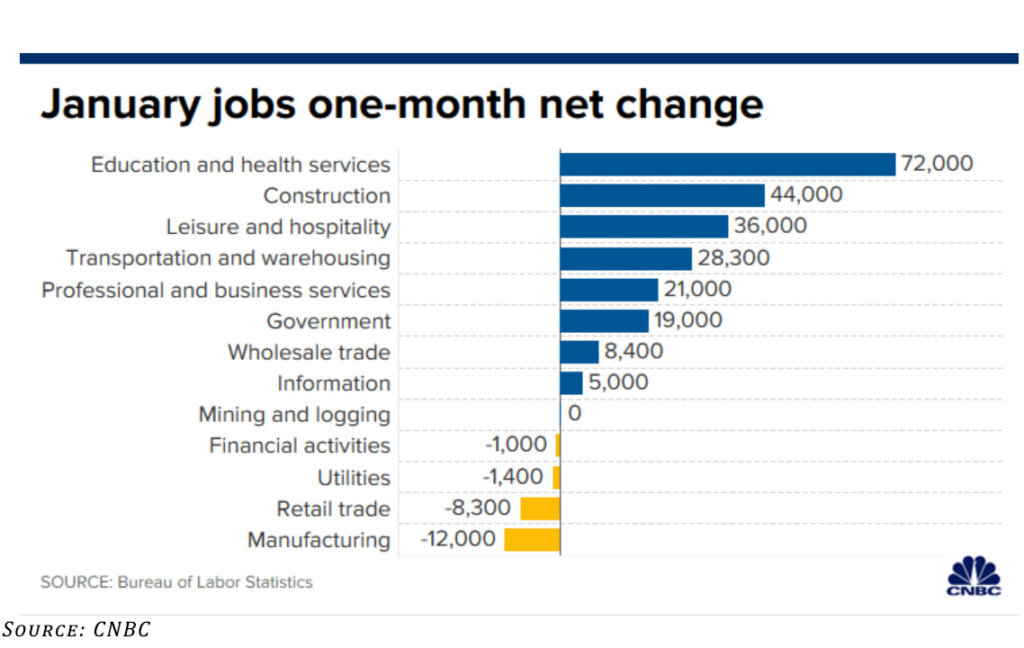

- We want to see employment remain strong. As I type, U.S. non-farm payrolls for January was released and indicated the U.S. created 225,000 jobs, well ahead of the 158,000 number which was forecasted.

- We want to see U.S. and global manufacturing activity expand. Earlier this month, the survey for manufacturing activity in the U.S. was released and showed a surprise increase. The number jumped to 50.9 (anything above 50 is expansion) reversing a 5 month contraction.

As The Joseph Group approaches 2020, we want to focus on scenarios, not forecasts. We want to have different game plans mapped out in advance and use the game plan which best matches what the data and activity is telling us. Right now, the data is telling us a “growth recovery” deserves the highest odds and is the playbook we should be working from.