Infrastructure – Not Just for Politicians

September 10, 2020

To Inform:

When you think of infrastructure investments where does your mind go? Bridges to nowhere? Members of Congress lined up at the trough to capitalize on pork barrel spending? I can see why those things may come to mind, but the kind of infrastructure one ought to think about are the income generating, already in place, physical assets that are essential to the daily life of society. Think cell towers, pipelines, airports, toll roads, and wind farms. These are just a few examples of the type of assets that are essential to the functioning of society and are known for their income potential as well as their high replacement costs. It is these characteristics – the indispensability, income, and difficulty to replace – that make infrastructure such an interesting investment opportunity.

In a world of very low interest rates, owning dividend-paying infrastructure stocks is one way of compensating for low rates. While government bonds have essentially no default risk, if your goal is to generate income in retirement, bonds don’t offer the same benefits they used to. To put things in perspective, consider this: a million-dollar portfolio invested solely in 10-year US Treasury Bonds in 1985 generated over 100,000 in annual income. That same portfolio today? It will generate around 6,000 in annual income.

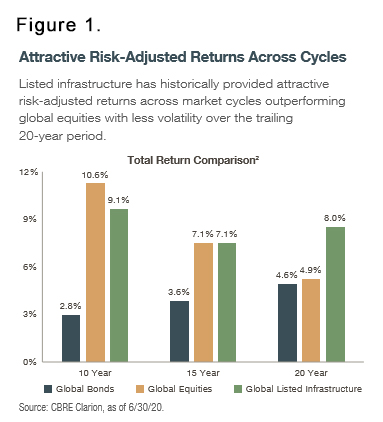

Historically, infrastructure stocks have generated returns that have not only outpaced global bonds, but global stocks as well (Figure 1). Over the last 20 years, roughly half of the returns in global infrastructure stocks have come from dividends and the other half from share price appreciation. They’ve done this while at the same time trading with less volatility than global stocks, capturing over 80% of upside moves in global stocks while capturing just 65% of downside moves in global stocks.

At the Joseph Group, we’ve allocated to infrastructure stocks in two of our objective-based portfolios. The regular dividends and opportunity for capital appreciation can satisfy the needs of both income and growth-focused investors. We’ve recently increased our exposure to these stocks, as we are optimistic about the prospects of infrastructure stocks going forward for a few reasons. One, infrastructure stocks are as cheap relative to global stocks as they have been since just after the financial crisis of 2008-09 (Figure 2.) Two, the dividend yield on infrastructure stocks relative to corporate bond yields is at historically high levels (Figure 3.). And three, infrastructure stocks have held up well in periods of rising inflation, something we’re paying close attention to.

Infrastructure stocks may not be as exciting as the latest e-commerce IPO or electric car company, but as a means of generating stable dividend growth and inflation protection there are few investment opportunities like them. Looking ahead, sustainable infrastructure assets (wind farms, solar farms, energy storage) and digital infrastructure (broadband, 5G) are areas likely to see increased investment. We’re careful making forecasts around here, but as long as people need cell phones, gasoline, and electricity, we think infrastructure stocks should continue to offer the dividends and growth they’ve been able to in the past.