Investing Amidst the Storm

November 3, 2023

To Inform:

I’ve always been fascinated by the weather and thunderstorms have always caught my attention. There is one thing I’ve never been able to understand about thunderstorms. Why is it that the skies are always at their darkest before the storm hits, while during the storm the sky tends to lighten? While undoubtedly there is a scientific answer to this question (let me know if you’ve heard it), there’s an interesting parallel with investing.

As market watchers we’re constantly on the lookout for storms. One of those storms is the multi-year high in interest rates. Think of the storm on approach (when skies were darkest) as being more about the rise in interest rates and less about the absolute level of rates.

The move this summer in long-dated bonds, particularly 10- and 30-year US Treasuries, was the latest approaching storm in markets. For much of August and September as rates moved higher pressure on real estate stocks, infrastructure stocks, utilities, and gold was intense. Some of these asset classes went into correction territory, down 10% or more from recent highs.

You’d think that news is all bad for these asset classes with rates at these levels. But like the change in the color of the sky once the storm hits, these parts of the market are behaving much differently than they were while rates were on their way up. Perhaps it’s behavioral psychology (investors assuming things will get worse) or perhaps it’s simple mean reversion, but the behavior in the areas of the market that we often assume do the worst with higher interest rates are leading the market over the last month.

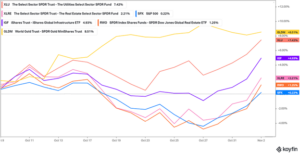

The table below shows the performance in utilities, global infrastructure, US real estate, global real estate, gold, and the standby we’re all familiar with, the S&P 500. Over the last four weeks some of the market leaders have been those areas that struggled the most when rates were moving higher. Perhaps it isn’t the level of rates (the storm) but the change in rates (the storm’s approach) that matters for these asset classes.

Source: Koyfin

One of the hardest tasks in investing is to avoid the temptation to respond in knee-jerk fashion and sell an asset class at the worst possible time, especially when the fundamental data doesn’t support it. On this latter point, TJG’s Investment Analyst Jake Lindaberry and I had a call with a portfolio strategist. This strategist works for a global infrastructure manager we employ in many of the client accounts we have the privilege of managing. Our call touched on the beating this asset class has had this year, but we also covered the outlook going forward.

Source: CBRE

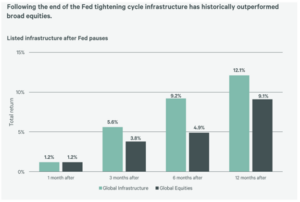

One of the things that stood out in our discussion was that the valuations of global infrastructure (utilities, pipelines, cell towers, toll roads, etc.) relative to global stocks are near record lows. Just as interesting was the historical record of this asset class after Fed rate hike cycles. In these historical examples rates were at peaks, but this asset class that the market loves to hate when rates are on their way up outperformed global stocks! If this week’s press conference with Federal Reserve Chairman Jerome Powell can be believed, we may be at the end of another Fed rate hike cycle.

Source CBRE

Investing is so often navigating the storms while having the courage to invest through them, often when it doesn’t feel right in doing so. Is this a science? Perhaps a bit. But there’s a behavioral element to it as well. We haven’t used the phrase in a while, but one of our goals at TJG is to build “all-weather” portfolios. Under fair skies an “all-weather” portfolio can tend to look a little boring. In other times, especially when storm clouds appear on the horizon, the “all-weather” approach is put to the test and suddenly that boring behavior can be a nice shelter.

Written by Alex Durbin, CFA, Portfolio Manager