Is Inflation Inflating?

January 22, 2021

To Inform:

As a new Presidential administration takes office, the stock market isn’t the only thing moving higher…so are measures of inflation.

Over Christmas break, we hosted a small COVID-safe family gathering at our house. Over dinner, my amazing mother-in-law, who appreciates finding good deals while shopping as much as I do, asked: “is it just me, or is it costing more to make a trip to the grocery store? It seems like all of the basics – milk, meat, bread…it all seems to cost more and our grocery bills are a lot higher than they used to be.” Since we were hosting dinner, I proceeded to agree and point out the rising costs of each food item we were serving that evening.

Source: Hedgeye.com

Do you feel like you are spending more on the items you typically buy? If so, you are not alone; various inflation measures across the economy are rising. According to The Leuthold Group, the Citi U.S. Inflation Surprise Index, which measures price increases relative to expectations, hit its highest level since 2008.

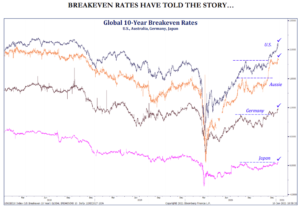

Source: The Leuthold Group

The bond market is flashing higher inflation readings as well. Back in August, we published a primer on how the bond market provides a forecast of future inflation. (Read it here: What is the Market Saying About Inflation? – The Joseph Group). In August, 2020, the U.S. bond market was pricing in an average inflation rate of about 1.6% for the next 10 years. Today, the same 10-year breakeven inflation rate in the U.S. is closer to 2.1% – a significant increase for a 10-year forecast within a 4-to-5-month period.

When it comes to rising inflation measures and the impact on the economy and markets, we have two key questions:

Does rising inflation mean the Federal Reserve is likely to increase short-term interest rates sooner than originally planned in order to keep the economy from overheating?

Our thought is not necessarily. Based on comments last week from Fed Governors, the Fed expects to keep short-term rates close to zero for the foreseeable future. According to Fed Chairman Powell: “When the time comes to raise interest rates, we’ll certainly do that. And that time, by the way, is no time soon.” (Source: Goldman Sachs, 361 Capital)

We note the Federal Reserve has indicated they want to keep inflation at an average level of 2%. The average implies that since there have been periods where inflation readings have run below the target, there will also be periods where the Fed will allow inflation to “run hot” for a period of time to maintain the average. All things being equal, we believe as long as inflation does not get out of control (which is the challenge) a stronger economy with continued stimulus through low rates is supportive of stocks and the economy.

Should rising inflation change my investment strategy?

A number of academic studies, including one published by investment firm Cohen and Steers in October of 2020, look at how asset classes respond to inflation surprises. They found the assets with the highest “inflation beta” or sensitivity to inflation surprises, included global real estate, infrastructure, and commodities.

Certain strategies within The Joseph Group’s objective based investment framework seek to allocate toward “Real Assets” which we define as a basket of these same three asset classes (global real estate, infrastructure, and commodities). We believe a diversified mix of Real Assets can not only provide attractive returns over a full market cycle, but they provide a potential “inflation hedge” when inflation may be negatively impacting other areas of the market. From a strategy standpoint, we moved from an “underweight” to “neutral” stance on Real Assets in late 2020, and would not hesitate to further increase our recommended allocation to Real Assets if inflation signs continue to accelerate.

Inflation is something that has a real impact on spending and therefore our clients’ financial plans. As we seek to use planning and portfolios as tools to support our clients’ purpose, accounting for inflation is a key part of the process.

This article was written by Travis Upton, Partner, CEO and Chief Investment Officer