Is Leadership Changing in the Stock Market?

August 2, 2018

To Inform:

Could the stock market be in the early stages of a shift in leadership from “Growth” stocks to “Value” stocks? At this week’s Portfolios at Panera discussion, we talked about major themes which have been areas of focus in The Joseph Group’s Investment Strategy Team meetings. One of those themes is a potential change in market leadership from Growth to Value and what that may mean for positioning our stock allocation within client portfolios.

Since the beginning of 2017, market leadership has been dominated by “Growth” stocks, which Russell Indexes defines as companies with rapid growth in sales over the last five years and a strong forecast for earnings growth looking two years forward. Over the last year, “Growth” has been synonymous with “Technology” as leadership has been dominated by mega-cap technology companies. Typically, these stocks will trade at a valuation premium as investors are willing to pay up for faster growth.

As “Growth” has led, “Value” stocks have lagged. Russell defines “Value” as stocks with a low price relative to their book value. Value stocks may have slower growth than Growth stocks, but they are generally less expensive based on various metrics, have steadier earnings, and are more likely to pay dividends.

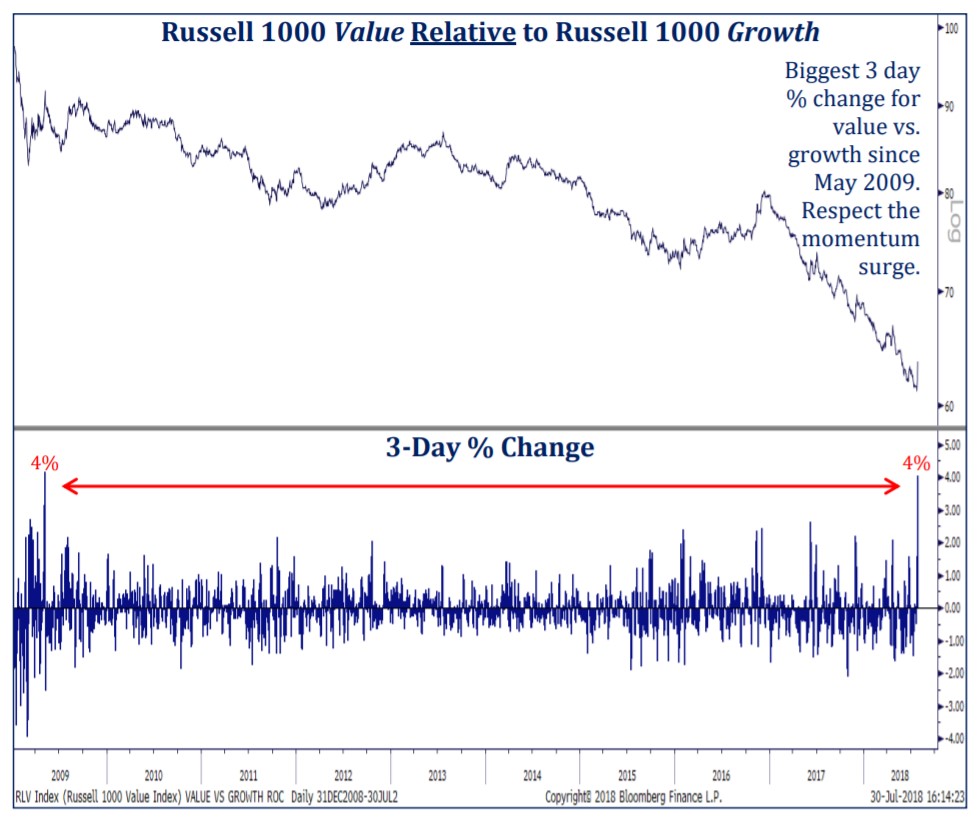

The chart below shows the performance of the Russell 1000 Value Index relative to the Russell 1000 Growth Index since 2009. When the line is moving up, Value is outperforming and when the line is moving down, Growth is outperforming. There are two things we find particularly interesting with the chart:

- First is the complete dominance of Growth since 2017. Momentum in Growth, particularly technology stocks, has been extreme and in some places has drawn comparisons to the 1999/2000 technology bubble. It’s worth noting that in the early 2000’s once the tech bubble burst, “Value” performance dominated that of “Growth.”

- Second is the little line at the end of the graph. Last week Value had its biggest momentum jump relative to Growth in almost a decade. And when we look under the hood, it is not just big stock price corrections in major social media companies driving the shift, it is also a rise in the price of “boring” industrial, financial, and healthcare companies.

Source: Strategas Research Partners

If market leadership is truly shifting from Growth to Value it has implications for the portfolios we manage. Within our Home Grown stock portfolio, we are always looking for underpriced stocks, but it would mean we will want to emphasize stocks with low price to earnings ratios and higher dividend yields. In our asset allocation portfolios such as Abundance, Harvest, and Provision, it would mean we want to choose funds and managers who do not have outsized allocations to technology and make sure we have a healthy exposure to other sectors such as financials, industrials, and utilities. We also would want to make sure dividends take more of a front seat role here as well.

We certainly are not calling for the death of growth stocks, but there are changes happening in the stock market when you look under the hood. It’s our job to make sure portfolios are ready for those changes.