Is This Time Different?

June 9, 2023

To Inform:

John Templeton a famous investor from a different generation once said, “The investor who says, ‘This time is different’, when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.” Few people at the start of the year would have called for a return in the S&P 500 of more than 10% by early June, but that’s what has happened. Many professional forecasters and strategists are bewildered as most expected that still high inflation and the bite of higher interest rates would lead to some volatility in markets. Many reliable indicators arguing for caution in markets have so far failed to predict what they have in the past, leading to the question, “Is this time different?”.

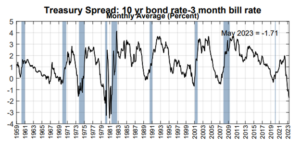

Historically one of the most reliable indicators, the shape of the yield curve has often been used as a means of determining the prospects for recession and how one might position their portfolio. The Federal Reserve Bank of New York has a recession model that considers the difference between short-term Treasury bills (3 months) and the 10-year Treasury bond. When the rate on the 3-month bill is higher than the 10-year, recessions have historically ensued. The chart below shows this relationship going back to the late 1950s. A number less than 0 means the yield curve has inverted and a future recession is likely. Recent readings show that the inversion in rates has reached levels not seen since the early 1980s. Is this time different – are we getting a false signal?

Source: Federal Reserve Bank of NY

A factor to consider when ascertaining the health of a stock market rally is just how many stocks are participating. In a typical market, the number of stocks outperforming the S&P 500 Index itself is closer to 40-50%. Today we’re sitting at around 20%. This number usually surges after a bear market, something we haven’t seen to any significant degree from the October 2022 low in stocks. Is it possible this time is different, that we’re in a new paradigm in markets where leadership is confined to just a few stocks?

Source: DisruptorStocks

Finally, bank lending standards have been tightening quite a bit. After occupying front page news in March and April, banks have faded from the headlines, but we think they’re still worth paying attention to. Historically, when banks have tightened lending standards, employment has softened. While we’ve seen lending standards tighten, employment remains quite strong. Is this time different? Will companies be able to ignore the impact of tighter lending standards, or will they dial back on their hiring plans?

Source: Strategas

To us it’s clear that there are caution lights illuminated on the dashboard. We’re wary of anyone who would claim “this time is different” when it comes to any number of indicators that have been reliable signals in the past. Lest you mistake us for permabears there are things we find encouraging including the recent performance in more economically sensitive parts of the market like small cap stocks. That said, we think a measured approach is worth taking until we see lasting progress against inflation and a move lower in interest rates. We’ll get plenty of news on this front next week, as June Consumer Price Index numbers come out and the Federal Reserve meets to discuss interest rate policy. Stay tuned!

Written by Alex Durbin, Portfolio Manager