Is Your Estate Plan Set Up for Success?

July 15, 2022

To Inform:

Death and taxes; we know the saying. In spite of the certainty, all of us fail to give our estate plan the attention it deserves. It’s easy to avoid and none of us enjoys thinking about our…well, you know. On top of that, you’ve already signed your estate documents so you’re done, right? What more is there to do? Well, consider the following:

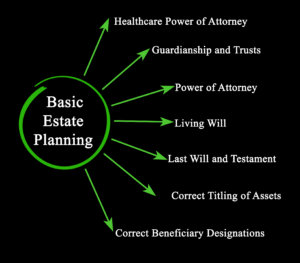

As the chart illustrates, there is much more to estate planning than signing our documents. We also need to title our assets correctly and coordinate our beneficiary designations with our plan. Let’s explore these two vitally important topics so your estate plan is carried out to success!

Asset Titling

In estate planning, it is possible for our documents to be bypassed. Let’s look at a simple example:

Judy is getting advanced in age. Judy’s estate documents leave all her money equally to her two children: Paul who lives out of state, and Frank who lives with Judy and is also her primary caregiver. To facilitate Judy’s care, Frank has been titled jointly with Judy on all her bank and investment accounts.

Question: upon Judy’s death, will Paul receive his half of all Judy’s assets? Answer: NO! The reason: account titling supersedes the estate documents. In this case, Frank will receive all Judy’s bank and investment accounts. The remaining portions of Judy’s estate (e.g. her house, car, etc.) will be split 50/50 between Paul and Frank. Judy should hope Frank likes Paul!

Beneficiary Designations

In order for our estate wishes to come to fruition, our money must flow to the right places at death. Let’s look at an example:

Bob and Betty have Wills, Trusts, Powers of Attorney, and Living Wills. They have young children and as part of their trusts, which provide protections for the children, they setup very specific parameters for when and how the kids would receive their inheritance. Bob and Betty die in a common accident leaving the children behind. In reviewing Bob and Betty’s assets, their attorney sees Bob listed Betty as the primary beneficiary on his large life insurance policy and the kids as equal contingent (secondary) beneficiaries.

Question: will the life insurance fund their trust? Answer: NO! Like asset titling, a beneficiary designation supersedes the estate documents. In the above case, the kids would still get the life insurance proceeds, however it would be outside of the trust giving them full access to it when they reach the age of majority and not in accordance with the trust provisions. This is why it is so important for our beneficiary designations to be in line with our estate documents. If Bob and Betty had consulted their attorney about the beneficiary designation, he or she would have recommended they have the contingent beneficiary be one of their trusts, assuring the funds are transferred in the manner they desired.

If we really want to see the importance of reviewing beneficiary designations and asset titling, consider what can happen in a blended marriage:

Mike and Maggie married later in life. They each have two children from a previous marriage. They bring different assets to the marriage and they want to protect those for their respective children. Their estate documents state if Mike dies, his assets go to his children with some smaller provision for Maggie, and vice versa. But, what happens if Mike dies and his primary beneficiary on his retirement accounts or life insurance is Maggie? Or what happens if Mike dies and he has a joint account with Maggie? All those assets go to Maggie, and unless she changes her estate documents or is generous towards Mike’s children, when she dies all her assets (which now include some of Mike’s assets) go to her children.

These are just a few examples of unintended consequences, but there are so many more. Our estate documents only work if our assets align with our plan when we die. Between now and then life happens! Our circumstances change, our finances change, our families change, and even our wishes change. With all that in mind, this is a fantastic season to review your plan. The past few months, we have seen so many of our clients meet with their attorneys, update their documents, and evaluate their account titles and beneficiaries. Let us help you too.

Written by Todd Walter, CFP, CPA – Partner and Chief Wealth Planning Officer