Lower For Longer And Inflation

September 17, 2020

To Inform:

Earlier this week the Federal Reserve announced they are planning to keep interest rates low for years to come, with the Fed’s own projections implying short term interest rates will remain at zero through 2023. Specifically, here is text from the Fed’s statement:

“the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

That’s a long sentence, but there are two key items we want to unpack from this statement:

-

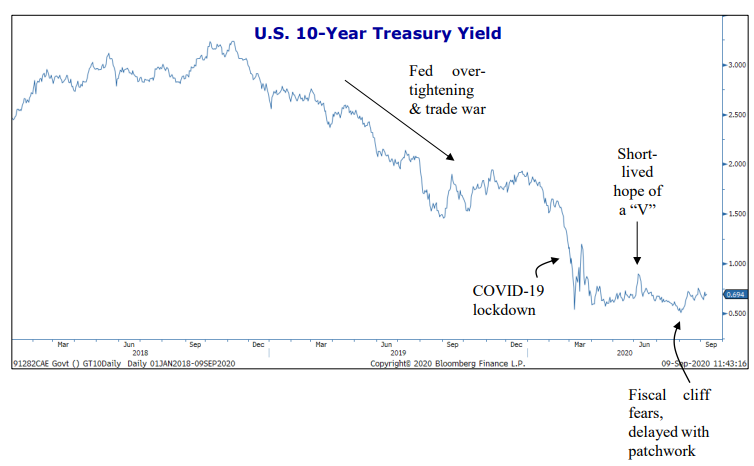

First, the Fed has direct control over short term interest rates, but by keeping short term rates low, longer term rates are also likely to remain low. As I type, the current interest rate on a 10-year Treasury bond is 0.67%. The 10-year Treasury is widely considered a benchmark for longer term rates and is important because changes in the 10-year rate have the biggest impact on things like mortgage rates. The chart below provides some perspective on where the 10-year Treasury rate has been over the last few years. Through much of 2018, the 10-year rate was close to and exceeded 3%. The rate declined through much of 2019, but it was not until COVID hit that the prior historic low of 1.37% (set in July, 2016) was breached and the rate hit new lows.

Source: Strategas Research Partners

Low long-term rates are stimulative to the economy, all else equal. Today’s record low interest rates are not only keeping mortgage rates low, supporting housing activity, but they also help support higher stock prices. Strategas’ Head of Technical Analysis Chris Verrone said this this morning, “strategically, it’s difficult to not interpret this as bullish for asset prices.”

-

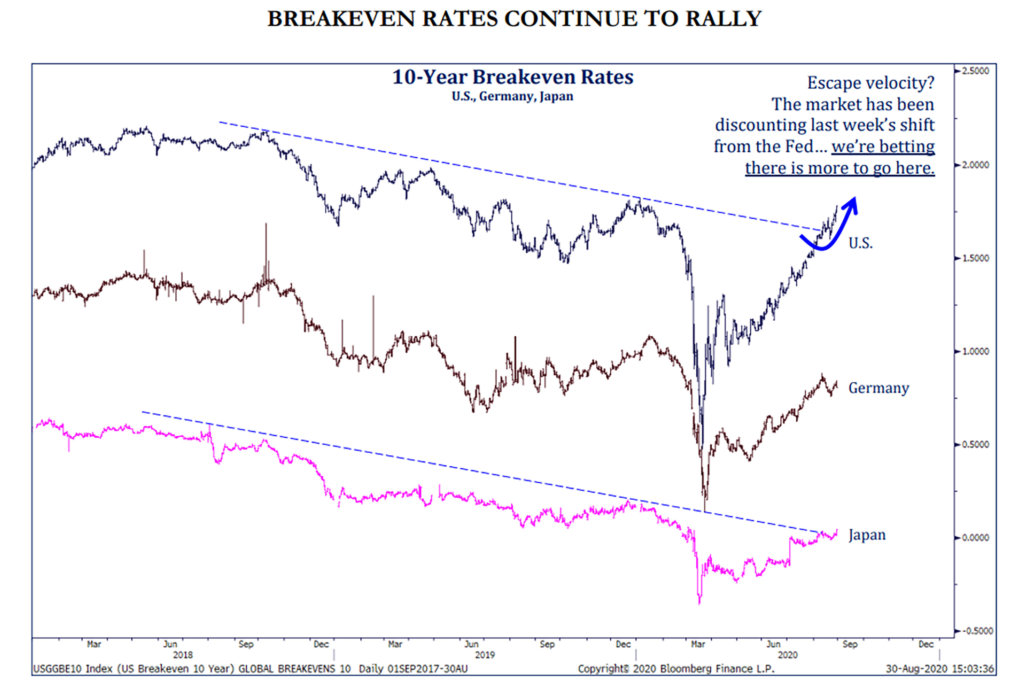

The second key item we want to unpack deals with inflation. The Fed has said they want inflation “on track to moderately exceed 2% for some time.” Currently the bond market is pricing in inflation to average 1.7% for the next 10 years (for a primer on how the bond market “prices” in inflation, check out this WealthNotes from August here: https://josephgroup.com/what-is-the-market-saying-about-inflation/).

Source: Strategas Research Partners

Inflation expectations were on a downtrend from about the 2% level prior to COVID, plunged in March, but have since recovered to pre-COVID levels. However, the Fed’s target of “moderately exceeding 2% for some time” is higher than the market’s current 10-year inflation pricing level of 1.7%. The implication is if the Fed is successful, inflation sensitive assets may outperform. In certain objective-based portfolios, we have strategic allocations to TIPS (Treasury Inflation Protected Securities) which would likely outperform conventional Treasury bonds if inflation expectations rise, in addition to Real Assets such as commodities and infrastructure which directly benefit from rising inflation.

Big picture, lower rates for a longer time is supportive of asset prices. And if the Fed succeeds in its inflation target, it not only has implications for asset class returns, but also for how we need to position portfolios to meet our clients’ objectives.