Mr. Powell Goes to Washington – Changing Facts and the Changing Playbook

March 10, 2023

To Inform:

“So, on behalf of the people of this country, to prevent a recession, yes or no Chairman Powell, will you pause future interest rate hikes?” This question was posed to Federal Reserve Chairman Jerome Powell by Rep. Ayanna Pressley from Michigan this past week as the Chairman testified before Congress. Powell ultimately responded with, “I don’t do yes or no on ‘will I pause interest rate hikes.’ That’s a serious question. I can’t tell you because I don’t know all the facts.” The Chairman’s response reminded me of the quote often attributed to the economist John Maynard Keynes – “When the facts change, I change my mind. What do you do, sir?”

The wisdom in Keynes’ quote and Powell’s response to the Congresswoman is that market actors (Fed Chairs, portfolio managers, retail investors) need to be willing to keep an open mind and be willing to change their minds if the facts change. Today’s market is one that is characterized by volatile reactions to short term labor market data, inflation data, and Fed speak. The sooner we realize this the sooner we can see the value in keeping an open mind.

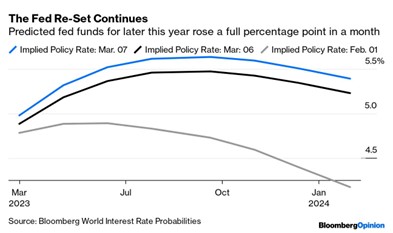

So, what has changed? Why is it that after a few months of apparently softening economic and inflation data the Chairman of the Federal Reserve is suddenly sounding less confident than he was a month or two ago? In a word, it was hot economic data from January. A blowout jobs number in early February followed up by evidence of more intransigent inflation in the mid-February inflation report has changed market expectations for where the Fed takes interest rates. In a little over a month, the market added nearly an additional 1% to expected Fed Funds through year end.

Source: Bloomberg

That’s a big move in a short amount of time! I had written a couple of weeks ago about “strange divergences” and how it seemed odd that the market wasn’t responding to these shifting rate expectations. It took Chairman Powell telling Congress, “The ultimate level of interest rates is likely to be higher than previously anticipated” for the market to begin to respond to this reality.

You might be reading this and thinking to yourself, “Great. I thought we dealt with this last year. I was hoping we could move on!” I can sympathize with those sentiments, but as I told a dear client just a week ago, this “reset”, while not great for anyone looking to make a quick buck in markets, is fantastic for retirees and savers.

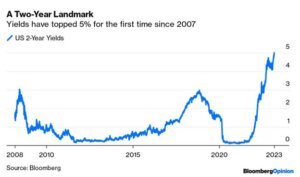

While many felt like balanced portfolios were as good as dead in the leadup to last year’s twin selloffs in stocks and bonds, there is new life once again for the balanced portfolio investor. It is all about the bond math. The 2-Year US Treasury Bond is now yielding more than 5%, a level we haven’t seen since President Bush was in office. Rates on longer-term bonds are in fact lower, but they are better positioned for price appreciation should rates fall in an economic slowdown.

Source: Bloomberg

In other words, despite subjecting themselves to nasty Fed bashing soundbites (a bipartisan pastime), the work of the Fed in the past year has pushed interest rates to levels where bond investors are again compensated for loaning out their capital. What’s more, rates again have room to fall should economic data begin rolling over.

We don’t envy the jobs of central bankers in a world where inflation is a problem. Assailed from nearly all sides, the work of the central banker to maintain price stability and full employment requires a willingness to respond to the facts and to acknowledge that there are tradeoffs to the decisions they must make. Patient investors can likewise embrace the changing data by investing in the sorts of things that benefit from the recent change in facts. To us, it’s the simple idea that owning bonds can once again fulfill the role investors have long ascribed to them – income generators and ballast in stormy seas.

Written by Alex Durbin, Portfolio Manager