Owning Investments No One Likes

April 29, 2022

To Inform:

It’s possible this has been said before in another time and place, but I like to think the maxim “You should always own something you don’t like” is an original thought of mine. An important corollary might be “be careful owning something everyone else loves”. I must say, however, that this rule should only be applied to investing. Don’t go out and buy that high mileage used German car with expensive repair costs (I’m speaking from experience). There are certain things you shouldn’t own! When it comes to investing, however, these rules may have a little more value.

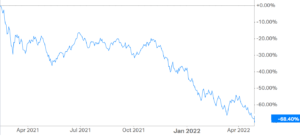

Owning things we don’t like in an investment context simply means owning things that the market “doesn’t like”. Understanding why a market doesn’t like something is key. Sometimes the market is right. We’ve seen a number of stocks towed to the impound lot this year. The chart below shows the returns of a popular ETF that owns many of these types of companies. In a little over 14 months, this ETF is down almost 70%! This particular ETF was the toast of the town a year ago. This should raise the astute investor’s hackles.

Source: Koyfin

A year ago, I can think of a few areas the market didn’t like. The chart below shows a couple of sectors and one individual stock that weren’t generating very much “buzz” but had compelling valuations, solid dividends, and engage in sleepy, “boring” lines of business that don’t change all that much. We see returns in the double digits, with returns of one sector ETF up over 80%. The returns leading up to this period in these sectors and stocks were middling. Their stock prices were lagging the high profile companies and investors certainly weren’t toasting them at cocktail parties. But the patient investor who held through these “lean years” and was willing to own something they didn’t like ended up doing well.

Source: Koyfin

In times where the market is behaving like it is today – rewarding winners and dramatically punishing losers – discretion matters. The costs of picking the wrong areas of the market to be in are high, but the rewards of being in the right places make the effort worth it. A great place to start is to look at the what parts of the market no one seems to like. One way to measure that is to simply look at fund flows. Looking at what either the market is selling en masse or what the market doesn’t seem to be buying by the truckload can shed light on interesting ideas. Despite impressive runs of performance recently, fund flows into places like energy stocks, consumer staples, and gold remain tepid.

In portfolios we have the privilege of managing for clients we’re always working to position portfolios to navigate the market environment as we see it. There have been a number of instances over the last couple of years where we’ve either sold something that seemingly the rest of the market wanted to own or bought something that few market participants seemed to like. While this rule isn’t fail safe, we’ve seen it work a number of times. David Dreman, a money manager who got his start in the 1970s said it well in his book Contrarian Investment Strategies, “The market doesn’t run on chance or luck. Like the battlefield, it runs on probabilities and odds.” We believe fishing in ponds that only a few others are fishing in – owning things people don’t like – is one great way to improve our odds.

Written by Alex Durbin, Portfolio Manager

Written by Alex Durbin, Portfolio Manager