Seeing is Believing – Opportunities in Small Caps and Foreign Stocks

December 22, 2021

To Inform:

“Bah! It’s humbug still. I won’t believe it!” These words, uttered by Ebenezer Scrooge in Dickens’ novel “A Christmas Carol” come just before the ghost of Scrooge’s old partner Jacob Marley pays him a visit. Hearing a disturbance down the hall, Scrooge dismisses it. Sometimes investors make the same mistake Scrooge did. We may hear and see rumblings of an opportunity, or a change afoot, but sticking with what has worked sometimes becomes our default response. It was only when Marley rattled his own chains after entering Scrooge’s room did Scrooge believe that the ghostly apparition before him was real. For investors, sometimes seeing is more helpful than hearing.

Small cap stocks struggled in the leadup to the COVID-19 selloff in early 2020, and were punished more heavily than their large cap peers in the midst of it. After an energetic breakout from the March 2020 lows, small cap stocks have languished since the first quarter of 2021. Peaks of sunshine in October and November were quickly snuffed at the end of November and into December, but the fact remains that small cap stocks are currently trading at a healthy discount to large cap stocks relative to history. The chart below illustrates this. Any time the blue line is below the red line, small cap stocks are trading at a discount to large cap stocks. While not as “cheap” as they were in heyday of the tech bubble, they’re solidly in the discount bin.

Source: The Leuthold Group

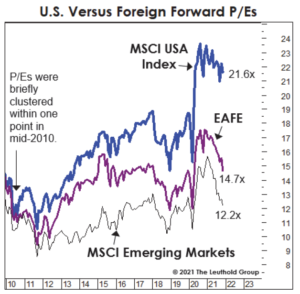

A little more than a decade ago, fresh off the stress of the Global Financial Crisis, US stocks, EAFE (developed countries outside the US) stocks, and emerging markets stocks were all valued together in a fairly tight range of 11-12 times earnings. At the beginning of December, these three markets traded in a range of 12-22 times earnings, with the US leading the pack. While the US is home to some truly world class companies, which may deserve to trade at a premium, this wide spread in valuations opens the door for owners of foreign stocks to potentially do quite well, especially if companies in these markets clear what amounts to be a pretty low bar of expectations.

Source: The Leuthold Group

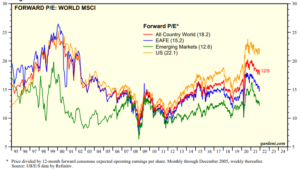

Despite our fondness for US equities, it’s important not to assume that the future will be a repeat of the past. Will US stocks go through another decade of expanding valuations? Can these gaps get even wider? Our view is that eventually, gravity applies. The chart below tracks earnings multiples in these various markets going back to the mid-1990s. The last time we saw gaps this wide, we saw a good run of outperformance in foreign stocks, even as absolute valuations came down.

Source: Yardeni Associates

While maybe not as powerful as a ghost shaking his chains in your living room, these charts illustrate a couple of corners of the market are worth paying attention to. If we see small cap stocks perk up in 2022, or if foreign stocks get out of the penalty box, we may be getting together at this time next year with a very different attitude than Ebenezer Scrooge!

Written by Alex Durbin, Portfolio Manager

Written by Alex Durbin, Portfolio Manager