Staying the Course in Challenging Markets

February 4, 2022

To Inform:

Mike Tyson, the electrifying boxer known for interesting aphorisms famously once said, “Everyone has a plan, until they get punched in the mouth.” Tyson was referring to an upcoming fight with Evander Holyfield and Holyfield’s “fight plan.” As a full-service wealth management firm, our view is that planning is important, but equally important is how we act when markets start landing haymakers. The start to 2022 has seen its share of them, to name a few: central banks turning “hawkish”, geopolitical risks, and disappointing earnings from a handful of market bellwethers.

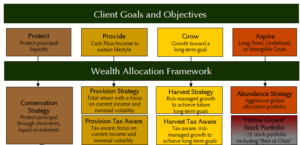

One way to handle these haymakers is to think big picture. For clients of the Joseph Group, our use of the Wealth Allocation Framework, the “bucketing” of financial assets by objective is one way to get through these bouts of volatility. For those near-term needs and goals, being cautious is one way to stay on your feet. In the portfolios we manage for clients that seek to reduce risk, our focus is on higher yielding stocks with reasonable valuations. For those longer-term goals, time is on your side. In portfolios we manage with an emphasis on higher return, we’ve been excited about places like energy, where the market doesn’t seem to be paying enough attention to long-term earnings and cash flow prospects.

Another way to “float like a feather” in volatile markets (yes, we’re mixing famous boxers now), is to diversify. This is a loaded term, as diversification can mean a lot of things. In this case, diversification by geography, asset class, and risk driver (i.e., the main thing which makes an asset class move up and down) are what I’m referring to. The latter point, “risk driver” is particularly important in a year like 2022, where bonds and stocks have both posted negative returns. The causes for this are for another WealthnNotes, but when stocks are getting dinged and interest rates are rising, it’s important to have something else working. For us, that has been our allocation to Real Assets across client portfolios. Here, the key risk driver is inflation. One of the most direct ways to benefit from inflation is exposure to commodities. We’ve seen that so far this year, with a popular broad commodity index up 10% and a well-known basket of energy stocks up 22%.

Finally, and maybe most importantly, one must not act on emotion. This isn’t easy when markets are flashing red, but the importance of making clear-eyed, rational decisions can’t be overemphasized. We’ve been active this year in the portfolios we manage for clients, but in a measured way. Market volatility gives us the opportunity to act, but we want to make sure it makes sense with the long-term objectives of the portfolios. In one portfolio we’ve increased in the use of funds which use options to add downside protection. In other portfolios we’ve trimmed back some of our recent winners and added to funds we feel have good upside from here. None of these moves will deliver the knockout punch against market volatility but getting to the next round sometimes is all it takes.

Written by Alex Durbin, Portfolio Manager

Written by Alex Durbin, Portfolio Manager