Stock Market: Volatility or Normalcy?

August 23, 2017

The stock market has seen some volatility within the last couple of weeks with concerns of threats between the U.S. and North Korea dominating the headlines. The VIX, a popular measure of market volatility, recently jumped by 55% to its highest levels of the year and U.S. stock market indexes have seen large moves in both directions.

The jump in volatility sounds ominous but in reality, a little more market volatility would be a return to normalcy. With the VIX tracing out all-time lows, the recent 55% jump only takes the volatility measure back to where it was last November. For more perspective, even with recent moves, the S&P 500 is barely off -2% from all-time highs.

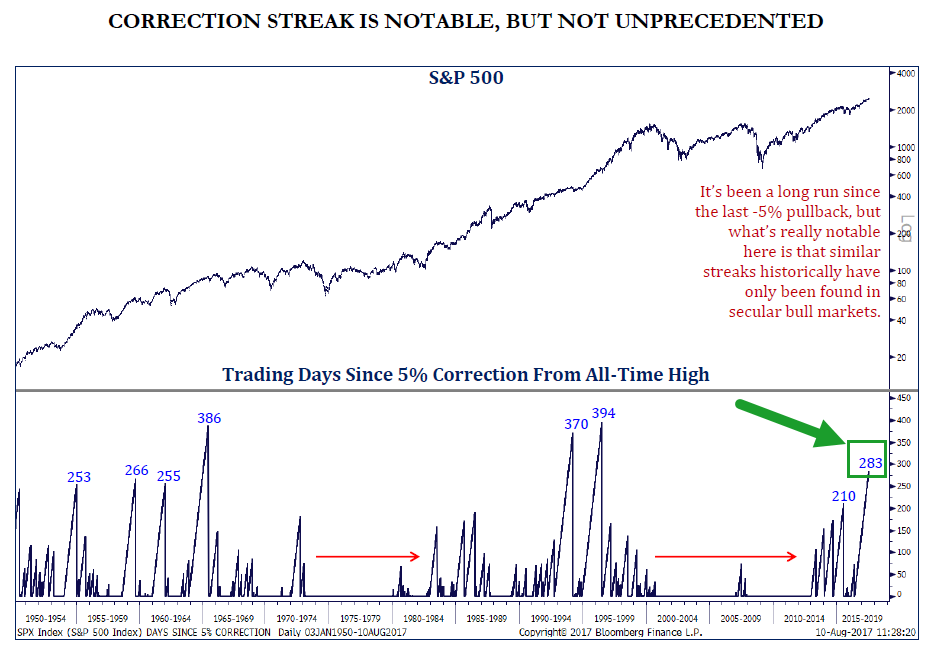

Even including numbers from the past two weeks, markets have been abnormally calm. As of August 10th, the S&P 500 went 283 trading days without a 5% pullback. Looking at history going back to 1928, there have only been three other periods where the market has gone longer without a 5% pullback (394 days in July of 1996, 386 days in June of 1965, and 370 days in March of 1994). The current market is clearly in a rare place, but for today’s streak to crack the top three, it is worth noting the market would have another four months or so of low volatility.

Source: Strategas Research Partners

Source: Strategas Research Partners

For the record, we expect stock market volatility to increase. According to research from JP Morgan, since 1980, the market has experienced a top to bottom pullback at some point each calendar year averaging -14.1%. Of course, that’s an average – the range since 1980 is -3% (1995 and so far in 2017) to -49% in 2008.

While we are optimistic about strong economic numbers and corporate profit growth across the globe, we recognize that record setting low volatility streaks do not go on forever. In the weeks ahead, clients are likely to see trade confirmations as we make adjustments to portfolios in ways that acknowledge the fundamental backdrop is positive, but the market seems to have a smaller “margin of safety.” By taking profits in various stocks and stock funds, we want to be positioned with some dry powder for the time when stock markets return to normalcy.