Streaks Are Made to Be Broken

February 2, 2018

To Inform: The U.S. stock market has had an amazing run recently, but it appears volatility is coming back into the markets. It may feel strange to see negative numbers on the market indexes, but we would say the volatility is not what is strange – it’s the fact the lack of volatility has lasted so long.

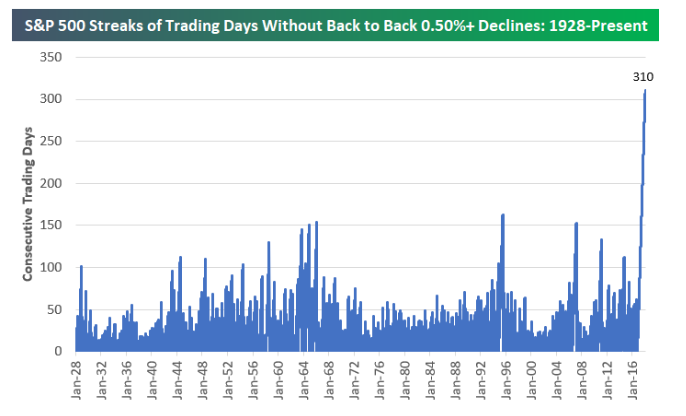

Earlier this week, the S&P 500 broke its current streak for the number of trading days without a back to back 0.50% decline. As you can see from the chart below, the current streak, which ended at 310 days without back to back 0.50% declines, was close to double the next longest period which was set in 1995.

Source: Bespoke Investment Group

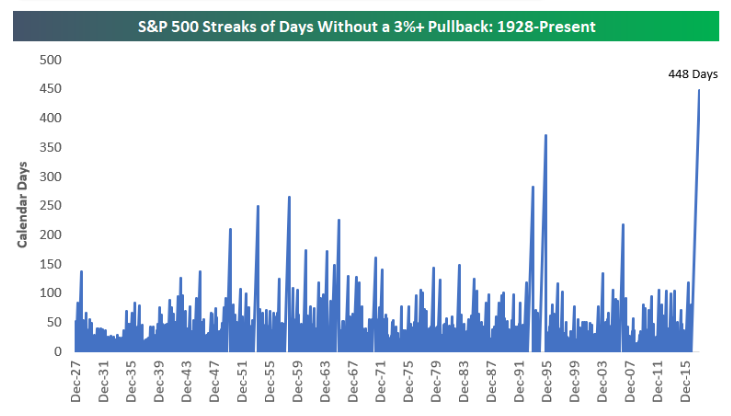

The next streak which is in danger of falling for the S&P 500 is the number of days without a pullback of 3% from a closing high. Currently, the streak sits at a record 448 days, but even with the Dow down 400 points as this note is being typed, the streak is still intact – we need to see even more volatility in the markets before that streak comes to an end.

Source: Bespoke Investment Group

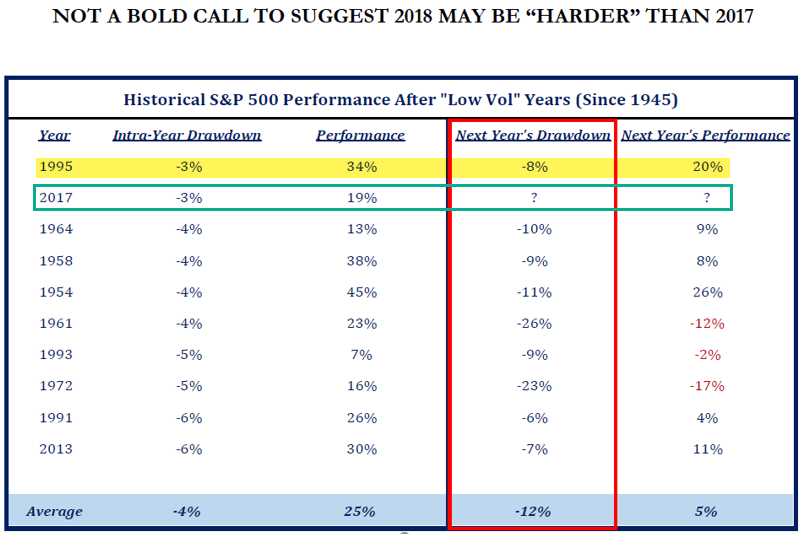

We would say the key question on investor’s minds is whether the recent volatility is a normal correction or the start of something more sinister. Below is a table we have been showing to clients in our monthly Market Health Analysis packet which may provide some perspective. The table shows what has happened to the S&P 500 in the year following low volatility years like 2017. On average, the market had a pullback the subsequent year of approximately -12% at some point during the year, but full-year performance was still positive. It is worth noting that in 1995, which was the year previous streaks were set, the S&P 500 had a -8% pullback during the year, but still had a full year return of +20%.

Source: Strategas Research Partners

With the stock market finally experiencing a pullback after such a long period without one, we believe it might make investor emotions run hotter than usual. When we look at the facts, the backdrop for corporate earnings and economic growth remains very positive and while we are very conscious of rising interest rates, the market is likely overdue for somewhat more “normal” behavior.

Have a great week!