Taking Stock of Q1 2023 Asset Class Performance

April 6, 2023

To Inform:

Earlier this week I was in a meeting with a client, and we talked about the challenging market last year in 2022. The client said, “I know, and everything is down again this year!” I replied that actually, most asset classes are positive so far this year and a balanced portfolio in the first three months of the year is likely up at least a couple of percent. The client then said, “What? That doesn’t make sense when everything is so rough out there.” Then I showed him the numbers…

The conversation illustrated here from earlier this week fits a discussion we have been having around TJG – things “feel” pretty terrible, and sentiment is depressed, but even with a couple of bank failures, economic data and market performance hasn’t been that bad.

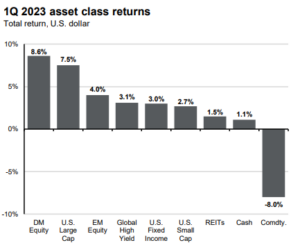

Below is a chart showing returns of selected asset classes for the first three months of 2023. With most asset categories having positive performance, diversified investors had pretty good odds of outperforming cash during Q1.

Source: JPMorgan Asset Management

Digging into the numbers, there are three key things which stood out most to us:

The worst performing asset category was commodities. During the first three months of the year, oil prices moved from about $80 in January to about $75 at the end of March, and that’s down from over $120 last June! Although we saw strength in gold prices (up about 8% in Q1), prices for commodities such as oil, natural gas, corn, wheat, soybeans, and pork all declined during the quarter. While that is not necessarily good news for commodity investors, it is good news for the future outlook for inflation.

The best performing asset category was developed market foreign stocks. Yes, for Q1, we used the phrases “best performing” and “foreign stocks” in the same sentence. Stocks in European countries and Japan largely outperformed U.S. stocks despite geopolitical headlines. Recently, a JPMorgan strategist described a “four legged stool” of why foreign stocks could continue to outperform:

- Foreign stocks are still trading at a wide valuation discount to the U.S.

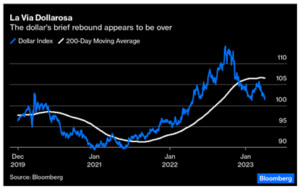

- A weaker dollar (which we are seeing in recent days – see chart below) would benefit foreign stocks

- Foreign stocks tend to have higher dividend yields than U.S. stocks

- The sector composition of foreign markets tends to favor more industrial and materials companies and puts less emphasis on technology, which could be a positive going forward.

Source: Bloomberg

U.S. large cap stocks performed well overall, but breadth was narrow. Last year’s market decline was characterized by big technology stocks being among the worst performers, but as the chart below seeks to illustrate, last year’s worst performers were this year’s best performers (and vice versa). Overall, performance within the S&P 500 was positive, but with a big gap between the largest 5 stocks (think big tech) which had strong bounces from their 2022 lows, and the other 495 stocks in the index.

Source: BespokeInvest.com

We’ve talked a quite a bit in recent investment committee meetings about a “grinding market.” Even with depressed sentiment about the issues of the day, asset classes have the ability to “grind higher” amidst the volatility. The result can be solid performance which outperforms cash even though it may not “feel good.” We saw that happen the first three months of this year.

Written by Travis Upton, Partner, CEO and Chief Investment Officer