The Market is Positive, but It’s Time to Look Under the Hood

March 21, 2018

To Inform:

As we are typing this note, the S&P 500 is slightly positive year-to-date 2018, but it’s time to look under the hood. To use a car analogy, the engine may be keeping things moving forward overall, but some components are working harder than others.

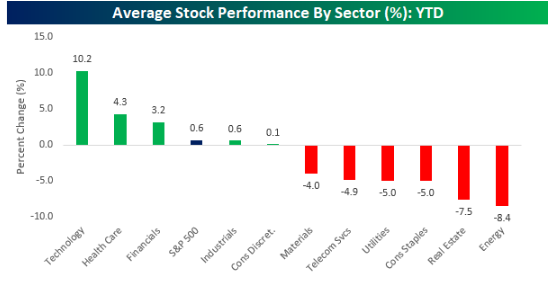

Out of the 500 stocks that make up the S&P 500, half are positive and half are negative so far this year. The split, though, is NOT evenly distributed – whether a stock is a “winner” or a “loser” so far in 2018 largely depends on what sector the stock is in. Based on the chart below and data from Strategas Research Partners, here are some of our observations:

The biggest winning sectors so far this year are technology, healthcare, and financials.

- Technology – over 82% of the technology sector stocks in the S&P 500 are positive, with an average gain of 10.2%. Technology as a sector lagged in 2016 but was dominant in 2017 and that dominance is carrying forward to this year.

- Health Care – over 63% of healthcare sector stocks in the S&P 500 are positive, with an average gain of 4.3%.

- Financials – over 61% of financial sector stocks in the S&P 500 are positive, with an average gain of 3.2%. Relaxed regulations and rising short-term interest rates have been a key factor supporting banks and other financial stocks.

Source: Bespoke Investment Group

Source: Bespoke Investment Group

The biggest losing sectors so far this year are energy, real estate, and consumer staples.

- Energy – only 25% of the energy sector stocks in the S&P 500 are positive, with an average loss of -8.4%. We find this particularly curious as oil is actually performing well and is trading above $62 dollars per barrel. There is currently a big disconnect between the performance of oil and energy stocks.

- Real Estate – only 12% of the real estate sector stocks in the S&P 500 are positive, with an average loss of -7.5%. We believe the impact of rising interest rates has hurt REITs in particular and are looking at the lagging performance as a potential buying opportunity moving forward.

- Consumer Staples – only 20% of the consumer staples stocks in the S&P 500 are positive, with an average loss of -5.0%. We’re looking for evidence but think rising inflation pressures could be playing a role here.

As we look across portfolios, we see three key implications:

- From a style perspective, growth is outperforming value. Technology and healthcare, in particular, have a larger weight in growth-oriented funds.

- Active managers are taking advantage of the sector disparity. The Joseph Group makes use of both active managers and low-cost passive index funds in client portfolios and based on strong category rankings from our active managers, stock picking seems to be adding incremental value.

- Rising interest rates and expectations for inflation to increase appear to be having an impact. The sectors struggling the most are sectors where the stocks end to pay higher dividends and are most sensitive to rising interest rates. As these more “defensive” stocks get cheaper, it could present a buying opportunity.

The S&P 500 is positive so far in 2018, but in the words of Paul Harvey, “now you know the rest of the story.”