The Trees Keep Growing

June 17, 2022

To Inform:

I recently got the chance to visit a timberland site in southeast Ohio with a group of investment professionals. On this visit were a number of professional foresters. One person asked the foresters about tree growth in regenerating timber stands. The forester gave an answer and connected it to what is going on in today’s markets. Markets will gyrate up and down, but, he said, “The trees keep growing.” I thought this simple statement was profound. Timberland owners aren’t pricing the value of their stands multiple times a day. They’re managing for the future, looking for opportunities, and biding their time while the trees keep growing. This view is naturally longer term in nature, but a worthwhile one as we take our own tour of several of the key asset classes we allocate to in client portfolios.

In High Quality Bonds, investors have been hit with a rise in interest rates over the last 2 years that accelerated at the beginning of 2022. Below is a 5-year chart of the US 10 Year Treasury Bond. After bottoming in the summer of 2020 at around 0.5%, rates are now comfortably above 3%. The move from 0.5% to 3% was painful for investors, as bond prices fall when yields go up. That said, the amount of “cushion” in owning bonds today is much higher than it was when rates bottomed. The negative impact on bond prices of a further increase in interest rates is offset by the higher yields offered. If rates were to fall, the combination of yield and price increases in bonds would be a tailwind for investors.

Source: Trading Economics

In what we label Credit, or “Junk Bonds” the pain of a move higher in interest rates has certainly been felt, but the spread between Junk Bonds and government bonds has widened to levels where investors are being more appropriately compensated for the risks they take in lending to below investment grade issuers. The effective yield of the US High Yield Index has risen from a cycle low of 4.01% in mid-2021, to 8.25% today. The attached chart may be hard to read, but even a quick glance reveals that yields on junk bonds are much closer to their historical norms than they were just 12 months ago.

Source: Federal Reserve Bank of St. Louis

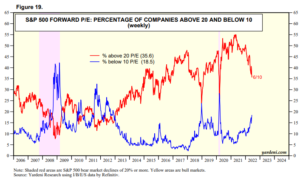

In Global Stocks, where most of this year’s pain has been felt, bargains are beginning to show up. The chart below shows the percentage of stocks in the S&P 500 trading at more than 20 times earnings and the percentage trading at less than 10 times earnings. In 2021 close to 55% of S&P 500 companies were trading at more than 20 times earnings, today that number is just 35%. More interestingly, after bottoming at around 5%, the number of companies trading at less than 10 times earnings is now close to 20%. That’s roughly 100 stocks that can be purchased for less than 10 times estimates of forward earnings.

Source: Yardeni Research

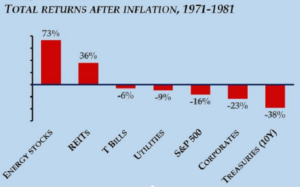

Real Assets have been a shining light in 2022. Real estate stocks have sold off as interest rates have risen, but have seen little deterioration in their business prospects. The closest analogue to today’s environment is the 1970s. Despite rising rates and high inflation, REITs (Real Estate Investment Trusts) were one of the best performing areas of the market then. While we think history doesn’t repeat it certainly can rhyme. An allocation to real assets, including real estate, remains one of our best defenses against inflation.

Source: Marketwatch

Bear markets are challenging. They are challenging to our emotions and our goals for the future, but they are a feature, not a bug, of financial markets. Well-constructed portfolios with one eye on risk and the other eye on the future can handle these periods. One of the foresters on our tour mentioned controlled burns in southern US pine plantations. He said they conduct these burns to clear out the understory and provide a better environment for the pines to grow in. In the long run, the trees aren’t bothered in the least. Bear markets can be a little like these controlled burns. They might seem intense, but if we do our job selecting good investments the end result will be portfolio of “trees that keep growing.”

Written by Alex Durbin, Portfolio Manager