Think Short-Term – The 3% Rate That Matters

May 4, 2018

To Inform:

Last week the interest rate on the 10-year Treasury bond hit 3% for the first time in over four years, prompting major headlines in the Wall Street Journal and much discussion at last week’s Portfolios at Panera. However, in The Joseph Group’s Investment Strategy Team meetings, it’s not the rate on the 10-year Treasury, it’s the rate on shorter-term bonds where we are focused.

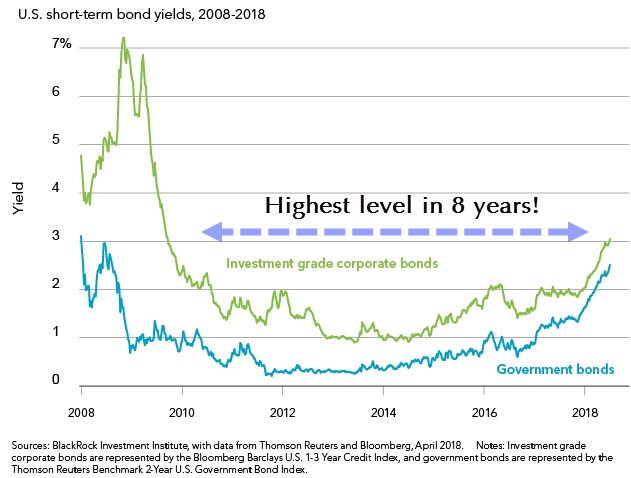

The chart below shows the prevailing interest rate for short-term bonds over the last 10 years. The blue line reflects the rate for 2-year government bonds and the green line reflects the rate for short-term investment grade corporate bonds. With the recent rise in interest rates, short-term corporate bonds are now paying interest rates of over 3% – the highest level in eight years!

Why is this important? Higher rates on short-term bonds mean we have a more effective tool to play defense with. To use a crude sports analogy, the offense (stocks) may be sputtering, but the defense (bonds) has more of an opportunity to put points on the board. Because they are paying higher rates, short-term bonds are a more effective tool than they were a few years ago for mitigating volatility and earning a little interest along the way.

Source: Blackrock Investment Institute

Clients of The Joseph Group may be noticing a few trade confirmations coming from the high quality fixed income portion of their portfolios. Shorter-term bonds are a key area of focus for our Conservation Strategy and we have been making changes where appropriate to make sure we are capitalizing on higher rates. We have also started to make some small buys to rebalance bond allocations within our more growth-oriented strategies. We expect rates to continue to drift higher in the months ahead, so it’s too early to make big shifts toward bonds. However, to the extent we can rebalance and build some higher yielding defense in portfolios, we are doing it.

The bottom line – interest rates on short-term bonds are rising, and our interest in using these short-term bonds as a tool in portfolios is rising as well!