Thinking (and Acting) Like the Smart Money

April 21, 2023

To Inform:

“Just because everything’s changing, doesn’t mean it’s never been this way before.” I heard this line in a song once and it was one of those things that sticks with me. So much of the human experience can be thought of in this way, including what we experience as investors. The world is changing, but it’s been this way before. Inflation was once so low that central banks were worried about how to make it go higher! Now, we see it and feel it everywhere. Interest rates have moved to levels we haven’t seen since before the 2007-2009 Financial Crisis. None of these changes are new. We’ve been here before.

An interesting way of thinking about these changes and how one might react to them is to think like an institutional investor. We often talk about the Smart Money/Dumb Money Index as a signal we look at. Thankfully, even though individuals and families may not have the resources that a large, “smart money” institution may have, we can still think and act like the smart money.

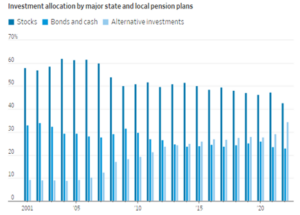

So, what is the smart money doing? Well, let’s start with what they were doing. A great window into what the smart money is doing is to look and see what state and local pension systems are up to. I spent several years working for a state pension system and during my time at this pension system the least favorite asset class was bonds. The smart money avoided them like the plague! With statutory return targets of 7-8% returns, it made little sense to own bonds when they were yielding 2-2.5%. The “golden children” were alternative investments – private equity, private real estate, private debt, and hedge funds. Consider the chart below from a recent Wall Street Journal article. The graphic shows how pension funds had to evolve their asset allocation over the last 20 years to reach their return targets. Over time, they were investing less in public stocks and bonds and more in alternatives.

Source: The Wall Street Journal

The world of the 2000s and 2010s is gone. The yield on a diversified bond portfolio has stemmed its multi-decade decline and now is well above 4%. The “alternative investments” that grew in such prominence aren’t going away, but are they as attractive as they were last decade? Private equity has become more challenged as interest rates have risen and competition for deals is fierce. Private debt offerings are seemingly a dime a dozen, but offer limited liquidity compared to plain old high yield bonds. Private real estate has its merits, but we think valuations today look a lot more interesting in publicly traded real estate investment trusts.

Perhaps in recognition of these changes, the Chief Investment Officer of the Los Angeles County Employees Retirement Association (LACERA) was quoted recently saying, “I think that the changing market environment with higher rates potentially changes everything, it changes how we think about allocation.”

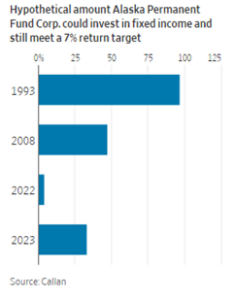

In other words, the smart money is realizing this changing world is nothing new but does indeed argue for a different playbook. Whether you’re a large pension system or a recent retiree there’s a number you need to hit to make your pension solvent or your financial plan work. And while there are multiple ways of getting there, in the end it’s the number that matters more than what you did to get there. The chart below illustrates the kind of round trip we’ve been on as investors over the last few decades. At one time, the Alaska Permanent Fund could have invested nearly all of their portfolio in bonds and reached their return targets. Last year, the optimal allocation to bonds was close to zero. In just one year that has rebounded to nearly 30%. In some of the objective-based portfolios we have the privilege of managing on behalf of clients we’ve made significant increases in bond allocations. In a changing, higher interest rate world could that number keep rising?

Source: The Wall Street Journal

Thinking like the smart money entails thinking about your goals and objectives. Start with the end in mind, and then ask what you need to do to get there. In the client portfolios we have the privilege of managing we believe much has changed and, like the folks at LACERA, are “opening up the playbook” for a different world. Oddly enough, this different world may actually require less in the way of exotic, hard to access, illiquid investments and more of the “simple” kinds of things that worked for investors in the past. Either way, our process is to think less about where we’ve been and more about where we’re going. We think that is “smart money” behavior, and the best way to set clients up for success.

Written by Alex Durbin, Portfolio Manager