Unpacking Themes Key to 2023 – Part 2

February 10, 2023

To Inform:

We began 2023 talking about key themes which we believed would impact markets, and therefore portfolio decisions, throughout the year. A few weeks ago, we talked about inflation and the prospect of recession (Unpacking Themes Key to 2023 – Part 1)…let’s unpack two themes related to asset classes.

Foreign Stocks: Could Shifting Winds Blow Investors Away?

By the way, we mean “blow investors away” in a positive context. Through February 9th, foreign stocks are starting 2023 the same way they ended 2022 – outperforming U.S. stocks. The chart below shows the S&P 500 (blue line) compared to three areas of foreign markets – the MSCI EAFE Index (developed international – think Europe and Japan), MSCI EM Index (emerging markets – think China, India, and Brazil) and the MSCI ACWI ex-US Index (All Country World excluding the U.S.). As you can see, the green lines have been above the blue line so far this year, and even with the S&P 500 making a push earlier this week, foreign stocks are maintaining a slight performance edge.

Source: Yahoo Finance

Our theme around “Shifting Winds for Foreign Stocks” posits foreign shares could outperform the U.S this year based on three important factors:

- The valuation gap between foreign and U.S. stocks is extreme with foreign stocks historically cheap

- The U.S. dollar appears expensive and could fall relative to other currencies

- The reopening of China after their COVID lockdown could provide a global economic catalyst

We believe foreign stocks outperformed last year (and so far this year) primarily because of the first factor – valuations are extreme.

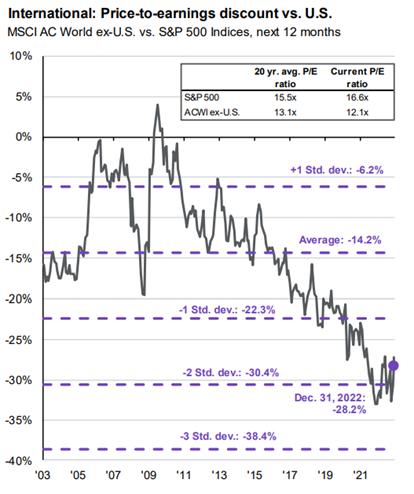

The chart below shows the valuation ratio of foreign stocks relative to the U.S. over the last 20 years. In 2009 (after the global financial crisis), foreign stocks actually traded at a slight premium to U.S. stocks. Now, starting 2023, valuations are trading at close to a 30% discount! Even if we agree foreign stocks should be cheaper than U.S. stocks, but we go back to the around -15% discount we saw in 2003-2005, it implies outperformance from current levels for foreign stocks.

Source: JP Morgan Guide to the Markets

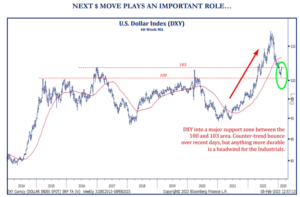

So far, we have not seen much of another potential catalyst for foreign stock outperformance – a weaker U.S. dollar. In general, a strong U.S. dollar hurts performance while a weak U.S. dollar helps performance of foreign stocks for U.S. investors. The weaker the dollar is, the more dollars U.S. investors receive (and thus higher returns) when foreign profits are converted to dollars (and vice versa).

Last year, the dollar was strong (red arrow in chart) and even though the dollar came off its highs in late 2022, the higher dollar had a negative impact on foreign stocks for the full year of about -9 to -10%. Here at the beginning of 2023 (green circle on chart) the dollar really hasn’t been a factor…yet.

Source: Strategas Research Partners

To sum it up, last year foreign stocks outperformed, even with a rising dollar headwind. So far in 2023, foreign stocks are outperforming with the dollar providing no wind. If the historic valuation gap between U.S. and foreign stocks continues to narrow (the China reopening could be a catalyst) AND a weakening dollar finally provides a tailwind, investors could be surprised, dare we say “blown away,” at the magnitude of foreign stock outperformance.

U.S. Stocks: Earnings and Multiples Both Move Prices

Earlier this week, TJG Portfolio Manager and resident walking encyclopedia Alex Durbin, CFA said to me, “this is a weird market – this has never happened before – stocks which are missing earnings estimates are outperforming stocks which are beating earnings estimates!”

Below is a picture of what Alex is talking about – notice with close to 20 years of data, the light blue line has never been above the dark blue…until this year. Typically, the market rewards companies which report earnings exceeding analyst estimates (an average of +1.01% outperformance against the S&P) and punish companies which report earnings below estimates (an average of -2.11% underperformance against the S&P). So far in 2023 we are seeing the opposite with the companies missing estimates outperforming.

Source: Goldman Sachs Global Investment Research

We think this is interesting because it harkens back to our theme around U.S. stocks for the year – earnings and multiples both move stock prices.

Last year, was a rough year for stocks across the board but investors may be surprised to know corporate earnings for most areas of the U.S. market were positive for 2022. The reason stock market performance was negative was the price investors were willing to pay for those earnings (the price to earnings, or P/E multiple) came down dramatically, making stocks cheaper.

Source: Goldman Sachs Global Investment Research

Entering 2023, corporate earnings are expected to fall as rising interest rates and a slowing economy make their impact. Our point with our “earnings and multiples both move prices” theme is that just as stocks fell last year with rising earnings, they could rise in 2023 with falling earnings. Why? The market tends to look forward…. prices tend to rise even as earnings and economic data is getting worse because the market is already anticipating an end to Fed rate hikes and a potential economic recovery. As the chart below shows, there have been plenty of times in history where the red bars (stock returns) have been positive even while the blue bars (earnings) are negative. We believe 2023 has good odds of this happening again.

Source: Strategas Research Partners

Returns for financial assets are off to a MUCH better start in 2023 than what we saw in 2022. It’s still early, but through early February, the themes of foreign stock outperformance and rising stocks despite weaker earnings, are not only playing out…they could have more room to run.

Written by Travis Upton, Partner, CEO and Chief Investment Officer