Weeks Where Decades Happen

May 22, 2020

To Inform:

“There are decades where nothing happens, and then there are weeks where decades happen”.

This quote, attributed to Vladimir Lenin, rings particularly true today. For long stretches of time, the social, political, and economic arrangements of a society operate within ranges that all participants can at least recognize if not agree with. The “weeks where decades happen” throw that order out of balance. It’s harder to see this early how changes to the social and political order play out, but we’re getting a very good glimpse of how the economic order is changing. We’ve touched on this in previous Wealth Notes and in our Portfolios at Your Place calls. Today I’ll touch on a few brief topics and how what’s playing out in the economic sphere may affect your investments. We’ll start with a look at housing, followed by a look at oil markets, and wrap up with a question about inflation.

The Housing Market

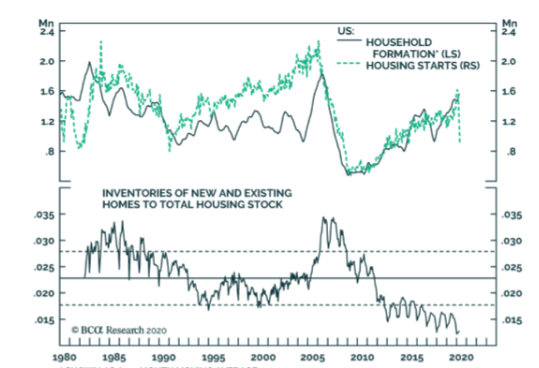

Is what’s happening today likely to dramatically upset or change the housing market? We all know that housing was the epicenter of the previous recession for reasons that don’t need repeating. A recovery in housing only took place when excess supply was worked off, higher borrowing standards were implemented, and new development took place at a more sustainable pace. While there may be some dislocation given society’s increased propensity to work from home, the housing market is in a much healthier position than it was in the late 2000s. The accompanying chart from one of the economic research firms we follow illustrates just how different things are today in the housing market. The bottom of the chart shows the inventory of new and existing homes for sale as a percentage of the nation’s total housing stock. At its peak in the late 2000s this number stood at nearly 3.5%. Today that number is closer to 1.5%. It will be difficult to see a tremendous decline in housing prices with supply so low.

Source: BCA Research

The Energy Market

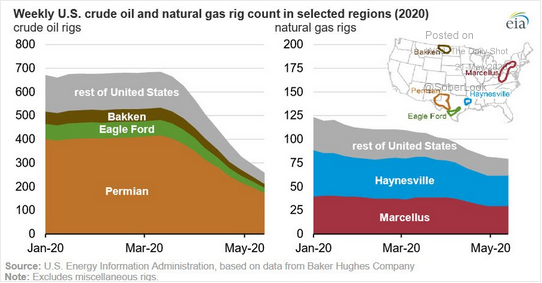

An area of the economy that is much more likely to be impacted by a global pandemic is the energy market. The one-two punch of demand destruction like we’ve never seen and the decision made by the Saudis earlier this year to keep the spigots open certainly qualifies as a “week in which decades occur” kind of event. In April, the supply/demand imbalance was so severe that the May contract for WTI oil went deeply negative for the first time in history. The likely result of this is higher prices at some point in the future. An old adage in the oil market goes like this, “The cure for low oil prices is low oil prices.” This tends to be the case because low oil prices lead to a reduction in exploration and production, eventually reducing supply. We’re seeing signs of that beginning to take place. The accompanying chart shows the swift decline in drilling rig counts in the US year to date. This trend isn’t unique to the United States. Around the world, energy companies are cutting capital expenditures to the bone. It may take some time to play out, but eventually these reductions are likely to weigh on supply.

Source: Wall Street Journal

Should We Worry About Inflation?

Finally, I want to touch briefly on the question of inflation. Outside of the “food at home” category, inflation is largely muted in the US. It’s been low for a number of years and is likely to stay low for the foreseeable future. You might wonder how inflation can’t be happening amidst this unprecedented amount of monetary expansion and fiscal stimulus. A simple way to think about it is to consider that in addition to the supply of money, a key determinant to changes in the price level is the velocity of money. The velocity of money measures how many times a unit of currency is “turned over” or used to purchase goods in a year. The graph below from the Federal Reserve Bank of St. Louis shows that the velocity of money is lower than it has ever been over the last 60 years. The “why” behind this graph is for another day, but the immediate takeaway is that for as long as this measure remains subdued, inflation is unlikely to move materially higher.

Source: Federal Reserve Bank of St. Louis

We’ve had the good fortune at TJG to be able to watch these events unfold with the support of you, our clients, and the benefit of conviction in our process. We know this is a tremendously unsettling time and that many things we’ve taken for granted will look different for a while, but in time some of those things will go “back to normal.” The things that have been fundamentally altered by this pandemic require us to ask a lot of questions, seek a variety of viewpoints, and ultimately chart a course that allows us to continue to deliver on our mission of “Helping our clients create great lives, one story at a time.”