What a Difference a Month Makes

March 20, 2020

To Inform:

It was a bit surreal writing “March 19, 2020” at the top of this paper as the date marks the one-month anniversary of the all-time high in the stock market. On February 19th, major stock indexes closed at their all-time high and economic numbers, corporate earnings, and consumer confidence were strong and showing signs of improvement.

Thinking about the past month gives me mixed emotions. First, it’s sad to think about all of the ways life has changed due to the coronavirus. Most people are working from home or have been laid off from their job, spring breaks have been canceled, and there are no professional sports to watch. Yesterday I was at the grocery store and felt myself give a half smile to a stranger as we passed each other (at a safe distance) in an aisle where the shelves were partially empty. We are living a reality very few people would have even fathomed one short month ago.

On the other hand, thinking about the date also had me thinking what life might look like on April 19th – one month from now. While it’s certainly possible we could still be locked down in our homes, I also have a lot of hope. Over the course of the last week, I have been blown away by the ways people have come together and have figured out new ways of doing things. My kids are having video calls and online lessons with their teachers, the drive through at a particular fast food restaurant by my house had cars double wrapped around the building, and there is a spirit of being in this together. A lot has changed in the last month, and a lot is going to change in the next month as well.

What Do We Do?

The biggest question on people’s minds, especially with regard to investments is what do I do now? As we discussed in last week’s Wealthnotes, we think this situation needs to be expressed from a dual perspective.

First, we need to acknowledge the reality of our current situation. There is no precedent in modern times for what we are dealing with right now, and it could last for a while. Everyone’s situation is different, but having liquidity to fund at least 3-6 months’ worth of living expenses makes logical sense and so does being adaptive as the reality changes.

Second, we need to acknowledge we will get through the situation and this too will pass. Earlier this week I received a sad text from a family friend who cuts my hair that she had been laid off due to the Governor closing barber shops. Regardless of what is going on, in a few weeks, I am going to get my hair cut and if things are reopening, I’m going to go out to dinner first. Knowing this will pass is where things get tricky from an investment perspective. History shows markets always bottom when the dire headlines are the worst and markets will start to recover far in advance of the fundamentals. By the time things “feel better” markets will have already had most of their recovery.

What Are You Seeing from Research Firms?

Every morning, by the time I have my 6am cup of coffee, I typically have 8 to 12 different research reports from investment firms. Here are some things we think are relevant.

- Lots of material concerning the slowing pace of coronavirus cases in China and Italy. With a slowing of cases, many factories and workplaces in China are coming back on line. Capital Group Vice Chairman Rob Lovelace said earlier this week, “If governments take swift action, it’s still a big economic shock, but then you have a recovery like we’ve seen in China and Singapore. Along those lines, we are already working on getting some of our associates back to work in Singapore.” We also note a report by JPMorgan released this morning saying their insurance analysts “expect a peak in Italy’s active virus cases by the end of the month.”

- We are well aware economic data is going to be abysmal over the next few weeks. Unemployment claims are likely to skyrocket due to layoffs and hit record levels, and double-digit contractions in U.S. GDP are likely. On the question of “do you think we will go into a recession?” we believe we are already in one. The economic situation is why comparisons to areas like China and Singapore are so important – their economic data was awful a month ago and is starting to recover. Markets reacted before economic data nosedived and they will react before the recovery as well.

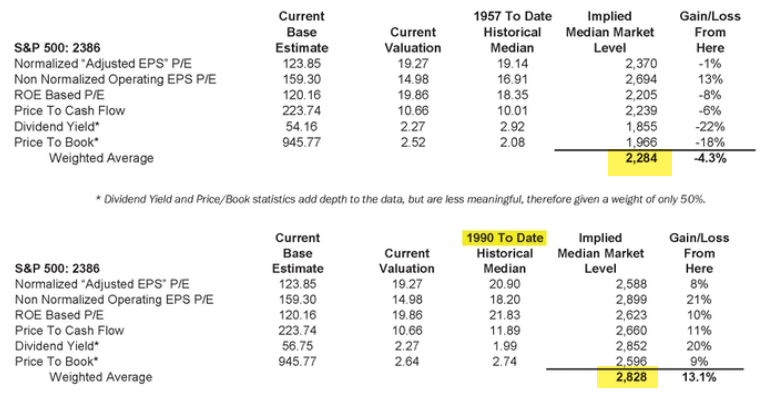

- We’ve had multiple research firms put together numbers trying to estimate the bottom for the stock market. Assumptions are key here, but assuming a sharp reduction in corporate earnings and a contraction in multiples, BCA Research estimates a target range for the S&P 500 of 2278 to 2468. The Leuthold Group went through a similar exercise noting a range of 2,284 to 2,828. While the sentiment of market participants will drive the day to day level of the S&P 500, it is interesting to see those numbers and note the recent low for the S&P 500 was Wednesday at 2,280 and as I type this, the S&P is at 2372.

Source: The Leuthold Group

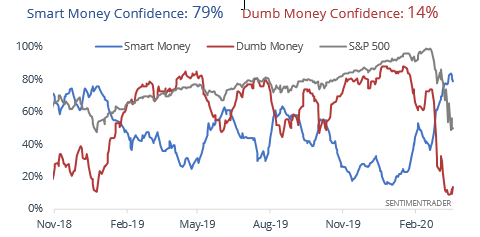

- Speaking of sentiment, we have seen countless studies showing panic has reached or exceeded the extremes associated with past market bottoms. We subscribe to research from “SentimenTrader” which publishes the Smart Money/Dumb Money indicator contrasting the behavior of large institutional hedgers with more emotional individual investors. The gap between the two is at a historic extreme. It is also worth noting that Sentimentrader’s research includes actual portfolio moves they are making and the firm was buying stocks earlier this week.

Source: Sentimentrader

- We’ve seen lots of research comparing 2008 to today. While the dive in the market is similar the causes – coronavirus economic shut down compared to overleveraged banks with subprime mortgages – are completely different. According to AGF Investments Chief Political Strategist Greg Valliere, “the banks are extremely well capitalized; the Dodd-Frank bill and activist Fed will insure there won’t be a liquidity crisis. This is not 2008, at least not from a bank standpoint.”

- In a further contrast to 2008, Strategas Research Partners Chief Strategist, Jason Trennert noted this morning, “the good news is the magnitude and the rapidity with which monetary, regulatory, and fiscal policy is being discussed stands in stark contrast to both 1929, when all government policies became restrictive, and 2008, when political wrangling led TARP to fail in Congress before it was passed.

- Finally, Strategas Research Partners released a list of items important to look for on a market bottom. We will come back to this in future notes but here are a few: 1. Extreme oversold conditions – close; 2. Steepening of the yield curve – this is happening, the yield curve is NOT inverted at any point; 3. Positive divergences from credit markets – this one is not there yet in our opinion.

Wrapping Up

Life has changed over the last month for everyone. We are so thankful to you our clients and we do not take the trust and confidence you place in us for granted. Our team is blown away by the calls and emails we have received asking us how we are doing. It’s amazing.

Again, we think the right approach is to acknowledge the reality of our current situation while at the same time acknowledging this will pass. Just as life has changed rapidly in the last month, we believe life will continue to change rapidly in the months ahead, and human ingenuity will seek to “make it better.”

Our purpose-based portfolios give us the ability to avoid “all or nothing” thinking and navigate these markets in different ways. For example, we may be unwinding corporate bond exposure in a strategy designed to “protect” at the same time we are seeking exposure to market leadership in U.S. growth and emerging market stocks in a more “aspirational” strategy. We’ve been having a lot of conversations with our clients about how we can use planning and portfolios as tools to align with their purpose. We’re thankful we are in this and will get through this together.