Will “Interest” In Municipal Bonds Go Up in 2021?

February 4, 2021

To Inform:

In December, TJG Portfolio Manager Alex Durbin and I had the opportunity to have a terrific meeting at a client’s home (with appropriate social distancing). In addition to enjoying some amazing Christmas cookies, we had an interesting discussion about an area of the financial markets which typically flies under the radar – municipal bonds.

Municipal bonds (or “munis” for short) are bonds issued by states and local governments. Essentially, munis are loans investors make to local governments and are used to fund the local governments, as well as to fund public works such as parks, libraries, roads, schools, etc. For investors in taxable accounts, interest paid on municipal bonds is often tax-free, making such bonds especially attractive for investors in high tax brackets.

For example, according to Eaton Vance, as of January 31, the current interest rate on the Barclays Municipal Bond 10-year Index is approximately 0.80%, while the rate on the 10-year Treasury was 1.09%. For an investor in the 37% tax bracket, the “tax-equivalent yield” on the municipal bond is (0.80% – 1 – 0.37) = 1.27%. In other words, even though the initial rate is lower, after taxes, the investor would earn more after-tax interest on the municipal bond than the Treasury bond.

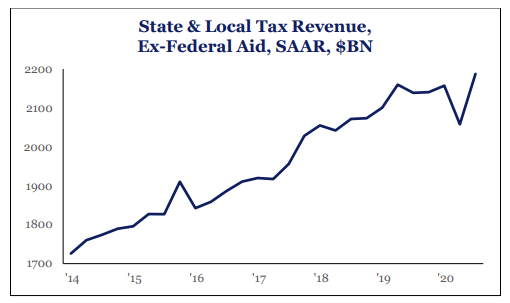

The conversation Alex and I had with the client was a thoughtful one. One concern we discussed was whether COVID and the economic shutdowns had dramatically hurt the tax revenues of local governments. It’s a valid concern, but it’s not what we are seeing in the data. The chart below shows state and local tax revenue excluding Federal Aid. Although aggregate state and local tax revenue initially took a dip with the COVID-related lockdowns, it is improving and hitting new highs. If you add in the idea that government stimulus proposals include measures for state aid, state governments may receive an influx of cash even though tax revenues are improving, resulting in solid fundamentals.

Source: Strategas Research Partners

Another area we discussed in the meeting was what might happen with investor interest in municipal bonds if a Democratic-controlled government raises taxes. The math here is pretty simple – the higher tax rates go, the more interested investors in high tax brackets are likely to be in municipal bonds. To drive home this point, as I’m typing this paragraph, my email inbox just dinged with a message from a fund company touting a new municipal bond ETF. We believe the more discussion is out there about higher tax rates, the more attention municipal bonds will get.

The Joseph Group has “tax aware” versions of our objective-based “Harvest” and “Provision” portfolio strategies where we actively use municipal bonds as one of several tools in the quest to minimize taxes for our clients. We’re cognizant though, with municipal bonds rising in popularity, it’s going to be even more important to sort through the opportunities which have the best chance of helping our clients meet their goals.

Source: Travis’ Cell Phone

Next week, we’re bringing in an expert to talk about those opportunities as the focus for our February Portfolios at Your Place event. I have the privilege of interviewing Nick Foley, a Senior Portfolio Manager with Segall Bryant & Hamill. Nick specializes in municipal bonds and is often seen quoted or interviewed in the financial media.

I’ve had the privilege of knowing Nick for a number of years and have shared a few gourmet Mexican meals with him. Some may think municipal bonds are boring, but Nick makes them anything but. We’ll talk about municipal bonds, the current environment, changes in tax policy, and, most importantly, where Nick sees opportunities that can support clients living out their purpose. It’s going to be fun – we hope you can join us.

RSVP for Portfolios at Your Place here.

Written by Travis Upton, Partner, CEO and Chief Investment Officer